Algorithmic trading is responsible for approximately 60-73% of all U.S. equity trading, according to BusinessWire. If you’re trading stocks manually, you naturally place yourself at a disadvantage; you’re competing against robots… and who do you think will win that fight? Nine times out of ten, it’s the robots.

Who Uses This Method of Trading?

You may be wondering: who runs these algorithms and who uses this method of trading? The aforementioned stats may shock you, especially if you’ve never heard the phrase “algorithmic trading” before. Hedge funds, investment firms, and other private equity trading groups all use algorithmic trading, mainly due to its decrease in costs, unrivaled speed, and increase in trading accuracy.

If you’re a little lost and don’t know what algorithmic trading is, don’t worry. To understand how this works, we must first explain how an algorithm works. An algorithm is a set of directions, usually inputted on a computer, to solve a complex problem. In basic terms, algorithmic trading, Python utilizes different algorithms to produce meaningful data, that is then used to determine whether to buy, sell, or hold during financial trades.

More often than not, when a firm utilizes algorithmic trading, they also use some form of trading technology to make thousands of trades each second. As these trades are real-time, this allows traders to maximize profit at any given moment – there are very few methods quite as accurate.

In more recent years, and especially since the 1980s, algo trading has increased in popularity, with many investors and investment firms choosing this new method of trading to increase their profit margins and see more accurate trading results. In fact, according to Toptal, hedge funds that utilize algorithmic trading have significantly outperformed their peers and counterparts since this time, all with reduced costs in comparison to regular trading. As of 2019, quantitative funds represented 31.5% of market capitalization, compared to 24.3% of human-managed funds.

The remainder of this article will discuss algorithmic trading in more detail, in particular, how it could make you more money.

What Are The benefits of Algorithmic Trading?

As mentioned beforehand, there are several benefits of algorithmic trading. However, the main benefits include:

- Cut down on associated trading costs

- Faster execution of orders

- Trades are timed perfectly

- Ability to backtest

- Quantitative strategies have dominated the market and returns

Each of these benefits will now be explained below in more detail, helping to provide you with greater insight on how exactly algorithmic trading works.

Cut down on associated trading costs

Firstly, when you use algorithmic trading, you are able to save and cut down on associated trading costs. Transaction costs are cut due to less human interaction, freeing up liquidity towards more investments. Likewise, you will also save money on fees, depending on your investment method – so it’s well worth keeping in mind.

Human interaction previously included general fees, a fundamental analysis performed by a finance manager, and the buying and selling of trades, amongst other actions. Algorithmic trading allows you to set a buy and sell price, cuts fees, and saves you money – let the robots work with you, not against you.

Faster execution of orders

With a faster system in place, traders are able to exploit the smallest of profit margins to create mid to large amounts of revenue in seconds. This method is called scalping and is where a trader instantly buys a set number of shares/stocks at a lower price, then rapidly sells these on for a higher price, whether for a small profit margin (which adds up in the long run) or for a slightly larger one.

When you use algorithmic trading, you can set a buy and sell price for a stock or share. For example, if one stock dips below a certain threshold, the algorithm will purchase a set number for you. Similarly, once this same stock increases in price to your pre-determined price, these stocks/shares will be sold instantly to maximize profit. This is much more accurate than human trades, and also removes the emotion involved with investing.

Trades are timed perfectly

Human trades require you to buy and sell manually, watching particular trades all day to purchase and/or sell at the best prices. With the predetermined buy and sell thresholds, your trades are timed perfectly.

This allows you to exploit small dips in particular trades, compounding small profits into large gains in the long run. The decision to buy or sell the trades is still yours, but you gain greater accuracy over when to buy and sell these.

Ability to backtest

One key advantage of algorithmic trading compared to regular trading is the ability to backtest, as mentioned by Nasdaq. Essentially, you can run algorithms based on previous data to see what parts of a trading system works, and what doesn’t. This is super beneficial and removes any potential error before purchasing stock or shares in bulk, possibly reducing a large loss.

Backtesting is not as accurate when human trading and may result in large losses – so keep this in mind if you choose the old fashioned trading method.

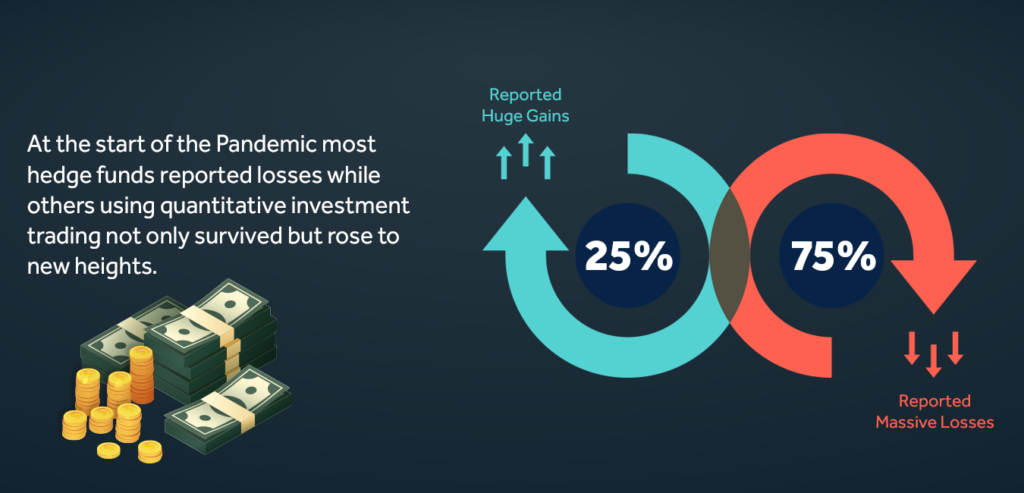

Quantitative strategies have dominated the market and returns

Hedge funds such as Two Sigma, DE Shaw, Renaissance, Bridgewater, and others have been the best performing investment funds in the world for several decades. Renaissance’s average of 39% annual returns have made the founder, Jim Simmons, and everyone else at the firm extraordinarily rich. Doing the math, at 39% per year for 30 years you could have turned just $100 into $1.9 million! That’s incredible, especially considering that they’re taking on much less risk than the stock market as a whole.

These funds are managed with greater accuracy and with a quantitative strategy, other than trading blindly, with emotion, and with an increased risk of a slip-up.

Are there any downsides?

Now that we’ve covered the benefits of algorithmic trading, you’re likely wondering if there are any downsides, and what they may be. As with all trading, there is an element of risk; however, you wouldn’t be in the business if you didn’t know this was a factor.

Potential downsides of algorithmic trading include:

- Loss of internet connection could prevent your order/trade from being processed

- Without prior testing, you may use the algorithm incorrectly and create a loss

Once again, each of these downsides will now be discussed individually below.

Loss of internet connection could prevent your order/trade from being processed

Firstly, as these trades require an internet connection, if your connection is to drop, even for a few seconds then your automated trades may not be placed and/or processed. This could lead to a loss, so it’s integral that you have a strong internet connection and ISP. ideally, you should have business WI-FI, as this is more reliable and more suitable to learn algorithmic trading.

The same risk is present with regular human trading, but it is something to be aware of, especially if trading in larger quantities.

Without prior testing, you may use the algorithm incorrectly and create a loss

The other downside is that without prior testing of the algorithm, you could create yourself a loss. This is easy to combat; all you need to do is play around with the system before placing any large trades. Start small until your comfortable then increase the number of trades and shares you are both purchasing and selling within a short timeframe.

You can also backtest, as mentioned previously to further increase the accuracy of your algorithm.

How does it work and how can it make you more money?

Algorithmic trading is made possible thanks to pre-programmed computers and a set of instructions to buy and sell trades in bulk. If done correctly, this allows you to make more trades than a human ever could, exploiting slight dips in the market for quick re-sales and easy profit.

First, however, you must identify an opportunity in the market. Running this through the algorithm and calculating the potential returns, deciding whether or the trade is worth it. Some trades will generate more income than others, but algorithmic trading is a long-term game, profiting off of small trades consistently for a greater ROI.

Do you want to learn more about algorithmic trading?

To find out more about algorithmic trading, you can take our unique, top-rated course designed for finance professionals and experienced programmers, allowing you to take your python for finance expertise to the next level. Not to mention make worthwhile investments, increasing your revenue, and be better equipped to solve real-world tasks and problems.

If you would like to learn more about our algorithmic trading course, click here.

Finally, we would like to draw attention to our open-sourced GitHub project, Lumibot. A great tool to use if you trade consistently and are looking to amp up your game, perhaps with algorithmic trading now on your side.